Nothing breeds complacency like unchallenged dominance. Just ask the German national football (soccer) team. Like this year’s World Cup squad, the German auto and energy industries have been spoiled by success in the past, and thus revered by the government and the public alike. Fundamental transformations in the rules of the game are forcing Germany’s football, auto and energy industries toward new creativity and competitiveness. With newfound momentum, things are looking up for the next rounds.

The Arrogance of Incumbency

Germany’s auto industry will spectacularly miss the government’s 2020 electrification target, with little repercussion. They’ve been coddled by government, barely challenged by premium competitors, and their lobby group, VDA, still wistfully looks backwards and defends diesel as “part of the solution” to climate change – a line which is echoed by VW, Mercedes, and others. Indeed, the industry’s can of governmental targets has simply been kicked down the road – with electric mobility now slated for a “fast phasing in” (Merkel).

In the “Land of Ideas” and innovation, the German auto industry may be merely a “fast-follower” on electrification. But one with a – still deserved – reputation for persistence, precision, and productivity (solidly trouncing their UK counterparts, for example). When automotive quality-fanatics look for a global benchmark, they still find it in Germany. When Chinese electric vehicle brands decide on a location for a European headquarters, many (Byton, Nio, and FAW) choose Munich. Besides some industry leaders and a wealth of talent in (auto-)mobility, Standort Deutschland now hosts several autonomous driving test environments, mobility blockchain projects, and a (self-proclaimed) mobility-as-a-service pioneer.

The Dark Secret of Germany’s Energiewende

But just as in automotive, the transformation has already begun, driven by a mix of startups and transforming industry giants. Novel ideas in vehicle charging (like this and this) are setting new standards; the country is top five for energy storage, and a benchmark for microgrids. Furthermore (and unlike in the US), the transformation is mostly being billed as bringing enormous opportunities and jobs.

The Promise of Momentum

Germany may no longer have the world’s best football team, but it has momentum.

Germany’s mid-sized business sector – the “Mittelstand” – already is the envy of the world, and now its startup environment is being prized as well. The country was recently ranked Number 1 worldwide by US News and World Report for entrepreneurship, ahead of Japan, the US, and the UK. Three of the top-5 biggest venture-capital deals in Europe in Q1 2018 were in Germany. Both Berlin and Munich consistently rank among the top 10 startup hubs in Europe, with Frankfurt, Hamburg, and Stuttgart also playing minor roles. One entrepreneur said, “It was incredibly easy to set up a business in Germany. At the time, I paid 20 euros and bam, I had a business” – in stark contrast to Germany’s stodgy and bureaucratic image.

For industrials, Mittelstand, and startups, the key is talent, and the key to that is Germany’s attractiveness to talent. Three of the world’s top 10 most livable cities (including this year’s number one – Munich) are in Germany.

With that, congratulations to my friends at Hyperion for opening up a new, Munich office. Leverage the momentum.

This article originally appeared here. It is part of a series of opinion-pieces written by Lukas Neckermann for Hyperion Executive Search. Lukas is Managing Director of Neckermann Strategic Advisors – a consultancy based in London, New York and Munich with a focus on the mobility revolution. He is an advisor to Hyperion Executive Search. (Disclosure: he holds long positions in a number of automotive and energy stocks mentioned in this article.) Title image: from League of Minnesota Cities.

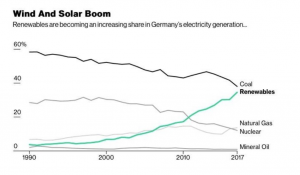

Just like its auto-industry, Germany’s energy industry has been heralded for its global leadership in

Just like its auto-industry, Germany’s energy industry has been heralded for its global leadership in  On the flip side, Germany was until 2017 also the world’s largest producer of brown coal (among the dirtiest of fossil fuels), prompting

On the flip side, Germany was until 2017 also the world’s largest producer of brown coal (among the dirtiest of fossil fuels), prompting